How Tax Consultant Vancouver can Save You Time, Stress, and Money.

Wiki Article

How Vancouver Accounting Firm can Save You Time, Stress, and Money.

Table of Contents5 Easy Facts About Small Business Accountant Vancouver ExplainedExamine This Report about Vancouver Tax Accounting Company4 Easy Facts About Tax Consultant Vancouver DescribedThe Buzz on Small Business Accountant Vancouver

That happens for each solitary purchase you make throughout an offered audit duration. Your accountancy duration can be a month, a quarter, or a year. All of it comes down to what works best for your service. Dealing with an accountant can aid you hash out those information to make the accountancy procedure help you.

What do you do with those numbers? You make modifications to the journal entries to make certain all the numbers accumulate. That might include making modifications to numbers or taking care of accrued things, which are expenditures or income that you sustain yet do not yet spend for. That gets you to the readjusted trial balance where all the numbers build up.

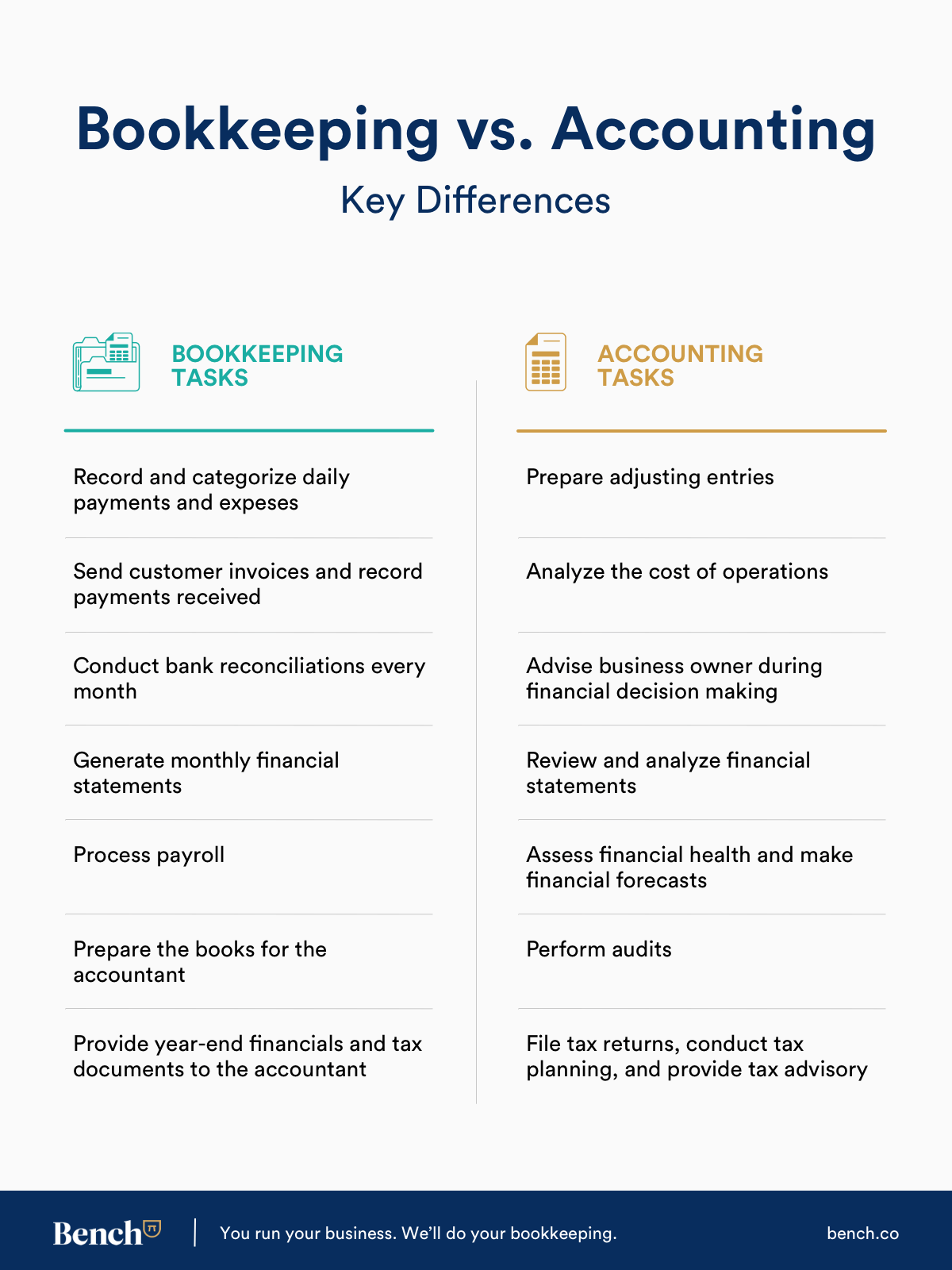

Bookkeepers as well as accountants take the exact same foundational audit programs. This guide will offer an in-depth breakdown of what divides accountants from accountants, so you can comprehend which accounting function is the finest fit for your profession desires currently and also in the future.

The 9-Second Trick For Pivot Advantage Accounting And Advisory Inc. In Vancouver

An accountant develops on the information given to them by the accountant. Normally, they'll: Evaluation economic statements prepared by an accountant. The documents reported by the bookkeeper will certainly establish the accountant's recommendations to management, as well as inevitably, the wellness of the service in general.e., federal government firms, universities, health centers, etc). A knowledgeable and also experienced bookkeeper with years of experience as well as first-hand understanding of audit applications ismost likelymore qualified to run guides for your service than a recent accountancy major graduate. Maintain this in mind when filtering applications; attempt not to judge applicants based on their education alone.

Service projections and also fads are based on your historical economic data. The economic data is most trusted and also precise when given with a durable and structured accountancy procedure.

Some Known Details About Pivot Advantage Accounting And Advisory Inc. In Vancouver

A bookkeeper's task is to keep total records of all cash that has come into and also gone out of the service. Their records enable accounting professionals to do their jobs.Usually, an accountant or owner supervises an accountant's job. An accountant is not an accountant, neither must they be taken into consideration an accounting professional.

3 main elements affect your expenses: the services you want, the know-how you require as well as your local market. The bookkeeping services your company requirements and the quantity of time it takes regular or monthly to finish them affect exactly how much it costs to work with a bookkeeper. If you need somebody to find to the office as soon as a month to integrate the books, it will cost much less than if you need to employ somebody full-time to manage your everyday procedures.

Based upon that computation, choose if you require to work with a person full time, part-time or on a job basis. If you have complicated books or are bringing in a great deal of sales, hire a certified or accredited bookkeeper. A skilled accountant can provide you assurance and also self-confidence that your finances remain in great hands yet they will certainly likewise cost you more.

An Unbiased View of Virtual Cfo In Vancouver

If you live in a high-wage state like New York, you'll pay more for a bookkeeper than you would in South Dakota. There are several advantages to hiring an accountant to file and record your company's financial records.

They may seek extra certifications, such as the Certified public accountant. Accountants might also hold the setting of accountant. Nevertheless, if your accountant does your accounting, you might be paying even more than you ought to for this service as you would typically pay even more per hour for an accountant than an accountant.

To finish the Pivot Advantage Accounting and Advisory Inc. in Vancouver program, accounting professionals must have 4 years of relevant job experience. CFAs have to additionally pass a difficult three-part test that had a pass rate of just 39 percent in September 2021 - Vancouver accounting firm. The point here is that hiring a CFA means bringing highly innovative accounting expertise to your company.

To get this qualification, an accounting professional has to pass the called for examinations and also have 2 years of professional experience. Certified public accountants can do a few of the same services as CIAs. Nevertheless, you could work with a CIA if you desire an extra specific concentrate on monetary danger analysis as well as protection surveillance procedures. According to the BLS, the average income for an accountant in 2021 was $77,250 annually or $37.

Report this wiki page